The Currency Without a Country: Why Blockchain Could Change How We Trade, Trust, and Live

Imagine this: you’re shopping online and come across a handcrafted leather jacket made by a small artisan in Buenos Aires. You click “buy,” and the payment goes through instantly—no conversion rates, no international fees, no bank involved. The seller gets the exact amount they expected. You get your jacket, no hassle.

This isn’t just a fantasy. It’s where we’re headed. Slowly, but surely.

The concept of a single global currency has floated around for years. Economists have debated it. Dreamers have envisioned it. But it’s only in the past decade or so that the technology to actually make it happen started taking shape. You’re probably heard the names already; blockchain, bitcoin, but understanding what they can really do requires looking past the headlines and hype.

At its core, this isn’t just a story about money. It’s a story about what happens when people are able to move value freely – without borders, without middlemen, and maybe even without governments.

What Makes Blockchain Different?

Most people think of blockchain and Bitcoin as one and the same, but that’s not quite accurate. Blockchain is the foundation, and Bitcoin is just one of the houses built on top of it.

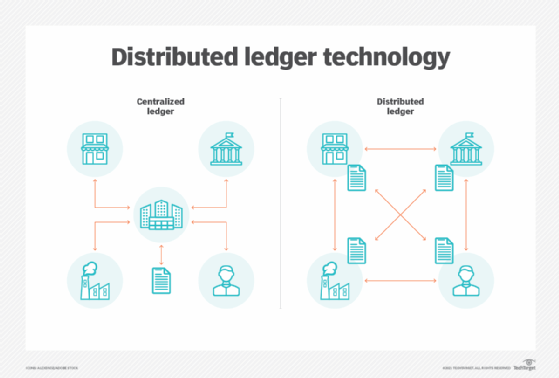

Think of blockchain like a giant spreadsheet – but one that lives on thousands of computers at once. When someone updates it (like sending you money), every computer in the network checks the transaction, agrees it’s valid, and updates the record. no single person or company controls it. That means you don’t need to trust a central authority to verify that something happened.

And once it’s written into the chain, it’s there forever. No edits, no erasing, no funny business.

This setup allows two people – complete strangers – to trade or exchange something of value online without needing a bank, a credit card company, or a third-party platform to make it happen. The trust is built into the system itself.

Why It Matters

Right now, financial transactions are heavily mediated. If you’ve ever sent money internationally, you know how slow and expensive it can be. Fees stack up. Transfers get delayed. And in many parts of the world, people don’t even have access to basic banking services.

In those cases, families rely on services like Western Union, where a simple wire transfer can cost a huge portion of what’s being sent. For people living paycheck to paycheck—or countries where inflation eats away at savings overnight—that’s more than an inconvenience. It’s a barrier to economic stability.

But if digital currency can exist outside of banks and governments, all you really need to participate in the financial system is a smartphone. That changes the equation entirely.

Bitcoin, which runs on blockchain, doesn’t care what country you’re in. It doesn’t care about your credit score or where you work. It exists online, and if you hold it, it’s yours. Full stop.

The Upside—and the Catch

Now, let’s be clear: none of this is perfect yet. Bitcoin is famously volatile. Regulatory frameworks are still developing. Scams and bad actors exist, just like they do in any emerging space.

But the potential is enormous.

Blockchain allows for traceable, tamper-proof transactions. That’s useful not just for sending money, but also for tracking supply chains, verifying the origin of goods, or making sure a product really is organic, ethical, or conflict-free. Once information is locked in, it can’t be changed. You can’t fudge the numbers. You can’t cover your tracks.

This kind of transparency could be a game changer for industries where trust is fragile—think voting systems, insurance claims, even real estate.

A New Kind of Infrastructure

We don’t often think about financial infrastructure. It’s just there. Banks exist. Credit cards swipe. We assume it all just works. But it comes with costs—fees, time, bureaucracy—and it doesn’t work equally well for everyone.

Blockchain offers a chance to rethink that infrastructure from the ground up.

Imagine building a financial system that doesn’t care about borders. One where everyone, no matter their income or location, can participate. No red tape. No 9-to-5 banking hours. Just access.

Of course, there are valid concerns. The environmental cost of certain blockchains has sparked real debate. Some governments view decentralized currencies as a threat to monetary control. And yes, for many people, the technology still feels abstract and intimidating.

But change always comes with friction. That doesn’t make the vision any less compelling.

The Takeaway

The real promise of blockchain isn’t just about cryptocurrency. It’s about rewriting how we think about trust, value, and ownership in a digital world.

Whether or not Bitcoin becomes a dominant global currency is still up in the air. But the ideas behind it—openness, decentralization, transparency—are already starting to ripple through the economy.

If nothing else, we’re standing at the edge of a shift. The question isn’t whether the way we move money and data will change. It’s how soon, and who will help shape what comes next.

And if the past few decades have taught us anything, it’s this: the systems we rely on today may not look much like the ones we’ll rely on tomorrow.

By Swaleh Saigal